does texas have an inheritance tax in 2020

12Heres why it starts so late. Does hawaii have an inheritance tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

There are not any estate or inheritance taxes in the state of Texas.

. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. Your 2020 tax returnsNew rule helps those who lost jobs in 2020 qualify for tax credits Fortunately there is. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive.

MoreIRS tax season 2021 officially kicks off Feb. There is a 40 percent federal tax however on estates over 534 million in value. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year.

The exemption was 117 million for 2021 Even then youre only taxed for the portion that exceeds the. First there are the federal governments tax laws. Maryland is the only state to impose both now that New Jersey has repealed its estate tax.

However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money so make sure to check that states laws. Currently only five states have an inheritance tax. For example in Pennsylvania there is a tax that applies to out-of-state inheritors.

Before 1995 Texas collected a separate inheritance tax called a pick-up tax. At 183 compared that to the national average which currently stands at 108. The short answer is no.

Finding Information About Taxes On Interest An initial gift of money or property is tax-free but if. Estates over that amount must pay estate tax on the amount not covered by the exemption and how big the estate is determines what. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received.

Inheritance taxes in iowa will decrease by 20 per year from 2021 through 2024. No estate tax or inheritance tax Utah. Use the annual gift tax exemption.

In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. No estate tax or inheritance. There is also no inheritance tax in Texas.

Comprehensive Guide to Inheritance Taxes in 2020. No estate tax or inheritance tax Vermont. For example you can save on inheritance estate and state income taxes by moving to Texas.

The state that stands out the most on map is Texas labeled as not tax-friendly. Its paid by the estate and not the heirs although it could reduce the value of their inheritance. While Texas doesnt have an estate tax the federal government.

T he short answer to the question is no. Estate tax applies at the federal level but very few people actually have to pay it. However in Texas there is no such thing as an inheritance tax or a gift tax.

The tax rates and the very existence of inheritance tax within specific states vary significantly. You can give a gift of up to 15000 to a person without having to pay a. Inheritances that fall below these exemption amounts arent subject to the tax.

The state of Texas does not have an inheritance tax. The big question is if there are estate taxes or inheritance taxes in the state of Texas. Does texas have an inheritance tax.

Washington has been at the top for a while but Hawaii raised. Texas Inheritance Tax and Gift Tax. An inheritance tax is a tax on the property you receive from the decedent.

Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. Rather a portion of the federal estate tax equal to the allowable state death tax credit on the federal estate tax return was deducted from amount due to the federal government and. However other stipulations might mean youll still get taxed on an inheritance.

In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax unless your estate is worth more than 1206 million. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Gift Taxes In Texas.

But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. But there is a federal gift tax that people in Texas have to pay.

The top estate tax rate is 16 percent exemption threshold. This is strange given Texas has no state income tax and no state estate tax. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

Hawaii and Washington State have the highest estate tax top rates in the nation at 20 percent. However Texas does have the sixth highest property tax rate in in the US. Texas does not have a state estate tax or inheritance tax.

In fact texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. 2 An estate tax is a tax on the value of the decedents property. The tax did not increase the total amount of estate tax paid upon death.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. The federal government eliminated inheritance taxes and instituted an estate tax policy that most states including Texas follow. Property owned jointly between spouses is exempt from inheritance tax.

There is no federal inheritance tax but there is a federal estate tax. In 2011 estates are exempt from paying taxes on the first 5 million in assets. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State And Local Severance Taxes Work Tax Policy Center

Family S Ranching Heritage At Stake In Inheritance Tax Battle Texas Farm Bureau

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

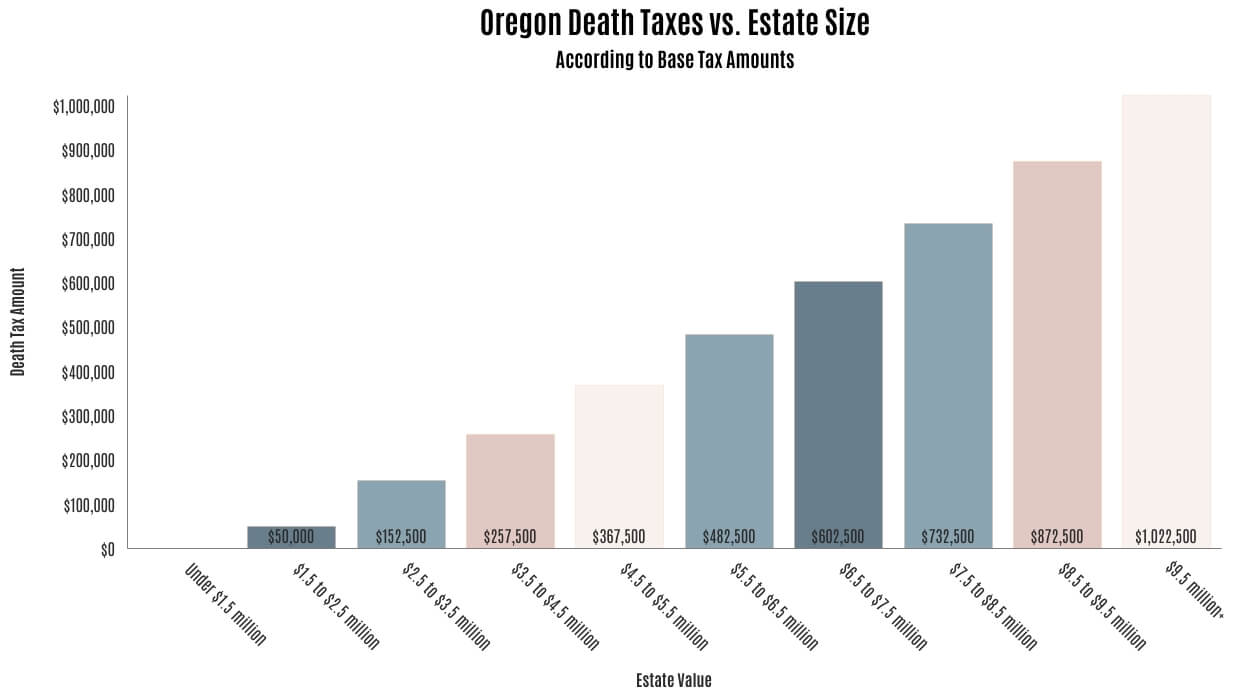

Death Taxes In Central Oregon De Alicante Law Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

States With No Estate Tax Or Inheritance Tax Plan Where You Die

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Recent Changes To Estate Tax Law What S New For 2019

Do I Have To Pay Taxes When I Inherit Money

Historical Texas Tax Policy Information Ballotpedia

How Is Tax Liability Calculated Common Tax Questions Answered

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Texas Inheritance And Estate Taxes Ibekwe Law

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center